Navigation

Academic Papers and Books

Accepted and Published Papers

- Pagnini, Francesco; Maymin, Philip; Langer, Ellen

Mindfulness, curiosity, and creativity

Behavioral and Brain Sciences, 2024, vol. 47, e110. - Guan, Jinping; Du, Xinyu; Zhang, Jiayue; Maymin, Philip;

DeSoto, Emma; Langer, Ellen; He, Zhengbing

Private vehicle drivers’ acceptance of autonomous

vehicles: The role of trait mindfulness

Transport Policy, 2024, vol. 149, pp. 211-221. - Chance, Don; Maymin, Philip Z.

A New Look at the Left-Handed Advantage in Baseball.

International Journal of Performance Analysis in Sport

2023 DOI: 10.1080/24748668.2023.2255806. - Camparo, Stayce; Maymin, Philip Z.; Park, Chanmo;

Yoon, Sukki; Zhang, Chen; Lee, Younghwa; Langer, Ellen J.

The fatigue illusion: the physical effects of mindlessness.

Nature: Humanities and Social Sciences Communications

2022, vol. 9, no. 331. - Maymin, Philip Z. and Maymin, Stella P.

Computational Mindfulness

Studies in Social Science Research

2021, vol. 2, no. 3. - Maymin, Philip Z. and Langer, Ellen J.

Cognitive Biases and Mindfulness

Nature: Humanities and Social Sciences Communications

2021, vol. 8, no. 40. - Maymin, Philip Z.

Using Scouting Reports Text To Predict

NCAA → NBA Performance

Journal of Business Analytics

2021, vol. 4, pp. 40-54. - Maymin, Philip Z.

Smart kills and worthless deaths:

eSports analytics for League of Legends

Journal of Quantitative Analysis in Sports

2021, vol. 17, no. 1, pp. 11-27. - Maymin, Philip Z.

Wage Against the Machine

International Journal of Forecasting

Special Issue on Sports Forecasting

April-June 2019, vol. 35, no. 2, pp.776-782. - Maymin, Philip Z.

The Conventional Past, Behavioral Present, and

Algorithmic Future of Risk and Finance

Finance - Challenges of the Future

2018, vol. 20, pp.74-84. - Maymin, Philip Z.; Maymin, Zakhar G.; Maymin, Zina N.

Behavioral Despair in the Talmud:

New Solutions to Unsolved Millenium-Old Legal Problems

Asian Journal of Law and Economics

May 2017, vol. 8, no. 2, doi:10.1515/ajle-2016-0027. - Maymin, Philip Z.

The Automated General Manager

Journal of Global Sport Management

2017, vol. 2, no. 4, pp.234-249. - Fisher, Gregg S.; Maymin, Philip Z.; Maymin, Zakhar G.

Risk Parity Optimality

Journal of Portfolio Management

Winter 2015, vol. 41, no. 2, pp.42-56. - Maymin, Philip Z.

Algorithmic Entangled Political Economy

Advances in Austrian Economics

2014, vol. 18, pp.213-236. - Fisher, Gregg S.; Maymin, Philip Z.; Maymin, Zakhar G.

Mutual Fund Outperformance and Growth

Journal of Investment Management

2014, vol. 12, no. 2, pp.8-13. - Maymin, Philip Z.; Maymin, Zakhar G.; Fisher, Gregg S.

Momentum's Hidden Sensitivity to the Starting Day

Journal of Investing

2014, vol. 23, no. 2, pp.114-123. - Maymin, Philip Z.; Maymin, Zakhar G.

Maimonides Risk Parity

Quantitative Finance Letters

2013, vol. 1, no. 1, pp.55-59. - Maymin, Allan Z.; Maymin, Philip Z.; Shen, Eugene

NBA Chemistry: Positive and Negative

Synergies in Basketball

International Journal of Computer Science in Sport

2013, vol. 12, no. 2, pp.4-23. - Maymin, Philip Z.

Schizophrenic Representative Investors

Complex Systems

2013, vol. 22, no. 1, pp.61-73. - Maymin, Allan Z.; Maymin, Philip Z.; Shen, Eugene

Individual Factors of Successful Free Throw Shooting

Journal of Quantitative Analysis in Sports

2012, vol. 8, no. 3, doi:10.1515/1559-0410.1414. - Maymin, Philip Z.

Music and the Market: Song and Stock Volatility

North American Journal of Economics and Finance

2012, vol. 23, no. 1, pp.70-85. - Maymin, Philip Z.; Maymin, Zakhar G.

Any Regulation of Risk Increases Risk

Financial Markets and Portfolio Management

2012, vol. 26, no. 3, pp.299-313. - Maymin, Philip Z. and Lim, Tai Wei

The Iron Fist vs. the Invisible Hand

World Review of Entrepreneurship, Management and

Sustainable Development, 2012, vol. 8, no. 3, pp.358-374. - Maymin, Allan Z.; Maymin, Philip Z.; Shen, Eugene

How Much Trouble is Early Foul Trouble?

International Journal of Sport Finance

2012, vol. 7, no. 4, pp.324-339. - Maymin, Philip Z.; Maymin, Zakhar G.

Constructing the Best Trading Strategy

Journal of Investment Strategies

2011, vol. 1, no. 1, pp.1-22. - Maymin, Philip Z.

Self-Imposed Limits to Arbitrage

Journal of Applied Finance

2011, vol. 21, no. 2, pp.88-105. - Maymin, Philip Z.

Markets are Efficient If and Only If P=NP

Algorithmic Finance

2011, vol. 1, no. 1, pp.1-11. - Maymin, Philip Z.

The Minimal Model of Financial Complexity

Quantitative Finance

2011, vol. 11, no. 9, pp.1371-1378. - Maymin, Philip Z.; Fisher, Gregg S.

Past Performance is Indicative of Future Beliefs

Risk and Decision Analysis

2011, vol. 2, no. 3, pp.145-150. - Maymin, Philip Z.; Fisher, Gregg S.

Preventing Emotional Investing

Journal of Wealth Management

Spring 2011, vol. 13, no. 4, pp.34-43. - Maymin, Philip Z.

Metanoia and the Market

Journal of Behavioral Finance & Economics

Winter 2011, vol. 1, no. 1, pp.27-42. - Maymin, Philip Z.

Regulation Simulation

European Journal of Finance and Banking Research

2009, vol. 2, no. 2, pp.1-12. - Maymin, Philip Z.

The Hazards of Propping Up: Bubbles and Chaos

International Journal of Business and Finance Research

2009, vol. 3, no. 2, pp.83-93. - Maymin, Philip Z.

Prospect Theory and Fat Tails

Risk and Decision Analysis

2009, vol. 1, no. 3, pp.187-195.

Published Book Chapters and Academic Editorials

- Maymin, Philip Z. and Maymin, Zakhar G.

Life, Liberty, and Lockdowns

In: COVID-19: A Complex Systems Approach

2021, Morales, Norman, and Bahrami, eds., STEM. - Maymin, Philip Z.

A New Kind of Finance

In: Irreducibility and Computational Equivalence

2013, Hector Zenil, ed., Springer Verlag. - Maymin, Philip Z.

Behavioral Finance Has Come of Age

Risk and Decision Analysis

2011, vol. 2, no. 3, p.125. - Maymin, Philip Z.

Why Financial Regulation is Doomed to Fail

Library of Economics and Liberty

March 2011.

Textbooks

- Financial Hacking

2012, World Scientific Publishing.

Also available on Amazon.com, Barnes and Noble, Blackwell's (UK), and more.

Working Papers

- Acceleration in the NBA: Towards an Algorithmic Taxonomy of Basketball Plays »

The Lambda-Q Calculus for Quantum Computation

- Extending the Lambda Calculus to Express Quantumized Algorithms »

- The Lambda-Q Calculus Can Efficiently Simulate Quantum Computers »

- Programming Complex Systems »

Mindfulness, curiosity, and creativity

(with Francesco Pagnini and Ellen Langer)

Curiosity and creativity are manifestations of novelty-seeking mechanisms, closely intertwined and interdependent. This principle aligns seamlessly with the foundational tenets of Langerian mindfulness, which places novelty seeking as a cornerstone. Creativity, curiosity, openness, and flexibility all harmoniously converge in this framework. Spanning over four decades, research in the realm of mindfulness has diligently delved into the intricate interplay among these constructs.

Available from Behavioral and Brain Sciences.

Citation: Pagnini F, Maymin P, Langer E. (2024). Mindfulness, curiosity, and creativity. Behavioral and Brain Sciences. 47:e110.

Private vehicle drivers’ acceptance of autonomousvehicles: The role of trait mindfulness

(with Jinping Guan, Xinyu Du, Jiayue Zhang, Emma DeSoto, Ellen Langer, and Zhengbing He)

Autonomous vehicles (AVs) are stepping into our daily life. The acceptance of AVs by people, especially private vehicle drivers (PVDs), would significantly influence the deployment of AVs and the future shape of our transportation. Trait mindfulness, characterized by novel distinction-drawing that results in being sensitive to the novelty, is an enduring mindset that may, though not certain, facilitate the acceptance of AVs. To provide an answer, a questionnaire survey was conducted and the 14-item Langer Mindfulness Scale is adopted to measure participants' trait mindfulness. A structural equation model is established based on the Technology Acceptance Model to explore the relationship between trait mindfulness and PVDs' AV acceptance. Results show that trait mindfulness is a positive predictor of PVDs' AV acceptance, and mindful drivers tend to be open to accept AVs and would become early users of AVs. Mindfulness could improve PVDs’ AV perceptions to promote AV acceptance. This finding contributes to the early promotion of AVs in practice, e.g., targeting AV advertisements to the mindful PVDs would be particularly effective.

Available from Transport Policy.

Citation: Guan, J., Du, X., Zhang, J., Maymin, P., DeSoto, E., Langer, E., He, Z. (2024). Private vehicle drivers’ acceptance of autonomous vehicles: The role of trait mindfulness. Transport Policy 149, 211-221.

A New Look at the Left-Handed Advantage in Baseball

(with Don Chance)

Using 120 years of Major League baseball data, we re-examine the apparent and widely presumed performance advantage of left-handers. We verify the previously known phenomenon that left-handers hit better than right-handers, but we show this advantage exists only because they face pitchers with the opposite hand far more often; they are not innately more talented. We find, however, that left-handed pitchers are indeed better than right-handed pitchers, and we show the perhaps unusual result that a player’s throwing hand plays a role in the quality of his batting. We further show that switch-hitting is largely ineffective, and we explore a symmetry puzzle in which batters of a given hand facing pitchers of a given hand do not bat similarly to batters of the other hand facing pitchers of the other hand. Taken together, we show that the handedness advantage in baseball is about more than the batting hand. Three handedness factors matter: the matchup advantage, the pitcher quality, and the natural handedness of the batter. Of the 40,320 possible rank orderings of the eight combinations of these three handedness factors, our theory predicts one specific order and finds that it indeed holds across the 1.8 million matchups of 15,000 players.

Available from the International Journal of Performance Analysis in Sport.

Citation: Chance, D., Maymin, P.Z.. A new look at the left-handed advantage in baseball. International Journal of Performance Analysis in Sport (2023).

The Fatigue Illusion: The Physical Effects of Mindlessness

(with Stayce Camparo, Chanmo Park, Sukki Yoon, Chen Zhang, Younghwa Lee, and Ellen J. Langer)

Attitudes that are blindly adopted, termed premature cognitive commitments, can place unnecessary limitations on how we perceive and engage in the world around us, including how we perceive fatigue. Fatigue is still widely treated as a somatic reaction, caused by physical limitations. In contrast to this, our hypothesis, based on Langer’s mind/body unity theory, states that people perceive fatigue at proportional milestones during a task, regardless of how long it is, how strenuous it is, or whether it is physical or cognitive, and that fatigue can be manipulated psychologically. Five studies were designed to investigate (a) whether or not proportional perceptions of fatigue, or fatigue milestones, exists, rendering fatigue an illusion and (b) whether perceptions of fatigue are malleable by way of Langerian mindfulness, offering individuals control in the management of fatigue. Study 1 introduced a fatigue scale and used retrospective perceptions about travel-fatigue. Study 2 added an objective measure of physical fatigue in a cognitive task. Study 3 tested the illusion of fatigue on an athlete population in a physical task. Study 4 included the Langer Mindfulness Scale to further study subjective perceptions of fatigue in physical tasks. Study 5 tested mindful interventions on fatigue. The findings indicate that (a) an illusion of fatigue exists, with proportional set-in and peak milestones, what we label the fatigue illusion and (b) constructs of Langerian mindfulness offer individuals control over the timing, amount, and even the experience of fatigue.

Available open access.

Citation: Camparo, S., Maymin, P.Z., Park, C. et al. The fatigue illusion: the physical effects of mindlessness. Humanit Soc Sci Commun 9, 331 (2022).

Computational Mindfulness

(with Stella P. Maymin)

We take a computational approach to investigating highly abstract concepts including mindfulness, brain waves, and quantum mechanics. Using Langerian non-meditative mindfulness, defined as the active process of noticing new things, we find that when tested on the authors as subjects in two different ways, induced mindfulness is consistently distinguishable from induced mindlessness, and results in a calmer time series of brain waves as measured on an electroencephalogram. Additional results include a statistical Granger causality analysis of scholarly mindfulness research showing that Langerian mindfulness research causes future mindfulness research but not vice versa, and preliminary results from another study showing substantial differences in responses among subjects induced to view their own faces either mindfully or mindlessly.

Available open access.

Citation: Maymin, Philip Z.; Maymin, Stella P. (2021), "Computational Mindfulness" Studies in Social Science Research 2:3. https://doi.org/10.22158/sssr.v2n3p88

Cognitive Biases and Mindfulness

(with Ellen J. Langer)

In a study testing whether mindfulness decreases cognitive biases, respondents answered 22 standard cognitive bias questions to measure susceptibility to the endowment effect, overconfidence, mental accounting, anchoring, loss aversion, and 17 other biases, as well as the 14 questions of the Langer mindfulness survey (LMS), measuring the traits of novelty-seeking, novelty producing, and engagement. A portion of the respondents were randomly pre-assigned to a condition that induced mindfulness. On 19 of the 22 biases, those induced to be mindful were less likely to show the bias. They also scored higher on 11 of the 14 LMS questions. The method by which we induced mindfulness was unrelated to the context of the later questions, involving image comparisons and standard Langerian instructions to notice three new things. People can boost their decision-making abilities merely by increasing their mindfulness, with no need for meditation, psychological training, or statistical education.

Available open access.

Citation: Maymin, Philip Z.; Langer, Ellen J. (2021), "Cognitive Biases and Mindfulness" Nature: Humanities and Social Sciences Communications 8:40. https://doi.org/10.1057/s41599-021-00712-1

Life, Liberty, and Lockdowns

We offer a computational model for evaluating tradeoffs between life and progress. Our framework evaluates people as cells in a one-dimensional outer-totalistic cellular automaton with two living states and an absorbing output state of death. Pandemics are modelled as instant death for a portion of the population and government regulations are modelled as lockdown restrictions on the number of consecutive neighboring cells in a certain state. With this model, we are able to compare the implicit trade-off between an unchecked yet instant pandemic and a continual governmental lockdown. We find that lockdowns lead to reduced complexity and increased death compared to a pandemic. If people are allowed to vote, they tend to vote for lockdowns early but regret their choice later. The findings suggest generally that societies can be robust to external attacks but can wither from internal attempts to control the mechanisms of progress.Available from the publisher at STEM Academic Press and as a computational essay at Wolfram Community.

Citation:Maymin, Philip Z.; Maymin, Zakhar G. (2021), "Life, Liberty, and Lockdowns," in COVID-19: A Complex Systems Approach, Papers and Commentaries, Alfredo J. Morales, Joseph Norman, and Mads Bahrami, Eds., STEM Academic Press.

Maimonides Risk Parity

Drawing on and extending an estate allocation algorithm of 12th century philosopher Moses ben Maimon, we show how "Maimonides Risk Parity" can link together the equal weighted, market capitalization weighted, and risk parity portfolios in a unified, elegant, and concise theoretical framework, with only a single intuitive parameter: the portfolio risk. We also compare the empirical performance of Maimonides risk parity with standard risk parity and equal weighted portfolios using monthly CRSP equity and bond returns for the past six decades and find that Maimonides risk parity outperforms risk parity for any value of the portfolio risk, and outperforms the equal weighted portfolio for most values of portfolio risk. We also discuss the optimal choice of portfolio risk. The superior performance of Maimonides risk parity comes from the algorithm's natural ability to robustly incorporate measurement error of seemingly small estimated risk.Available on SSRN and open access.

Citation: Maymin, Philip Z.; Maymin, Zakhar G. (2013), "Maimonides Risk Parity," Quantitative Finance Letters 1:1, 55-59.

SSRN Top Ten Download Lists

- ERN: Other Econometric Modeling: Capital Markets - Risk (Topic)

- Econometric Modeling: Capital Markets - Risk eJournal

Mutual Fund Outperformance and Growth (with Gregg Fisher and Zak Maymin)

Does better performance lead to more assets? We examine nearly 30,000 mutual funds to determine the effect that a fund's outperformance relative to its peers has on the fund's later asset size. We find that a fund that earns ten percent more than the size-weighted average of its peers in its style group in one year will on average experience an extra five percent excess asset growth in the subsequent year. The findings are robust to all types of fund styles and all fund sizes, with two exceptions: small funds of any style, and very large fixed income funds.Available on JOIM and abstract on SSRN.

Citation: Fisher, Gregg S.; Maymin, Philip Z.; Maymin, Zakhar G. (2014), "Mutual Fund Outperformance and Growth," Journal of Investment Management 12:2, 8-13.

Media and Press

- InvestmentNews: Do mutual fund managers have an incentive to perform?

Risk Parity Optimality (with Gregg Fisher and Zak Maymin)

We show under general conditions that the probability of risk parity beating any other portfolio is more than 50 percent. We also prove the maximin properties of risk parity portfolio under two scenarios: 1) when all assets' future Sharpe ratios are greater than some positive unknown constant and all correlations are less than another unknown constant, or 2) when the sum of all assets' future Sharpe ratio is greater than some unknown constant. In each case, we show that risk parity is the unique maximin portfolio. Finally, we empirically confirm our theoretical results for the two main asset classes.Citation: Fisher, Gregg S.; Maymin, Philip Z.; Maymin, Zakhar G. (2015), "Risk Parity Optimality," Journal of Portfolio Management 41:2, 42-56.

SSRN Top Ten Download Lists

- ERN: Other Econometric Modeling: Capital Markets - Risk (Topic)

- ERN: Other Econometrics: Mathematical Methods & Programming (Topic)

- Econometrics: Mathematical Methods & Programming eJournal

- Econometric Modeling: Capital Markets - Risk eJournal

- Risk Management eJournal

Media and Press

- IIJ Practical Applications Report: Risk Parity Optimality

A New Algorithmic Approach to Entangled Political Economy: Insights from the Simplest Models of Complexity

Economic models based on simple rules can result in complex and unpredictable deterministic dynamics with emergent features similar to those of actual economies. I present several such models ranging from cellular automaton and register machines to quantum computation. The additional benefit of such models is displayed by extending them to model political entanglement to determine the impact of allowing majority redistributive voting. In general, the insights obtained from simulating the computations of simple rules can serve as an additional way to study economics, complementing equilibrium, literary, experimental, and empirical approaches. I culminate by presenting a minimal model of economic complexity that generates complex economic growth and diminishing poverty without any parameter fitting, and which, when modified to incorporate political entanglement, generates volatile stagnation and greater poverty.Available on SSRN.

Citation: Maymin, Philip Z. (2014), "A New Algorithmic Approach to Entangled Political Economy: Insights from the Simplest Models of Complexity," in Steven Horwitz, Roger Koppl (ed.), Entangled Political Economy (Advances in Austrian Economics, Volume 18), Emerald Group Publishing Limited, 213-236.

Presentations

- 3rd Biennial Workshop on Austrian Economics at the Wirth Institute for Austrian and Central European Studies, University of Alberta.

Media and Press

Momentum's Hidden Sensitivity to the Starting Day

(with Zak Maymin and Gregg Fisher)

We show that the profitability of time-series momentum strategies on commodity futures across their entire history is strongly sensitive to the starting day. Using daily returns with 252-day formation periods and 21-day holding periods, the Sharpe ratio depends on whether one starts on the first day, the second day, and so on, until the twenty first day. This sensitivity is higher for shorter trading periods. The same results also hold in simulation of independent and identically lognormally distributed returns, showing that this is not only an empirical pattern but a fundamental issue with momentum strategies. Portfolio managers should be aware of this latent risk: starting trading the same strategy on the same underlying but one day later could, even after many decades, turn a successful strategy into an unsuccessful one.

Citation: Maymin, Philip Z.; Maymin, Zakhar G.; Fisher, Gregg S. (2014), "Momentum's Hidden Sensitivity to the Starting Day," Journal of Investing 23:2, 114-123.

Media and Press

- NYU News: Engineering researcher unearths timely advice for portfolio managers

SSRN Top Ten Download Lists

- Econometrics: Single Equation Models eJournal

- Financial Engineering eJournal

- ERN: Time-Series Models (Single) (Topic)

Schizophrenic Representative Investors

Representative investors whose behavior is modeled by a deterministic finite automaton generate complexity both in the time series of each asset and in the cross-sectional correlation when the rule governing their behavior is schizophrenic, meaning the investor holds multiple seemingly contradictory beliefs simultaneously, either by switching between two different rules at each time step, or computing different responses to different assets.Available on SSRN and on arXiv and on Complex Systems.

Citation: Maymin, Philip Z. (2013), "Schizophrenic Representative Investors," Complex Systems 22:1, 61-73.

NBA Chemistry: Positive and Negative Synergies in Basketball (with Allan Maymin and Eugene Shen)

We introduce a novel Skills Plus Minus ("SPM") framework to measure on-court chemistry in basketball. First, we evaluate each player's offense and defense in the SPM framework based on three basic categories of skills: scoring, rebounding, and ball-handling. We then simulate games using the skill ratings of the ten players on the court. The results of the simulations measure the effectiveness of individual players as well as the 5-player lineup, so we can then calculate the synergies of each NBA team by comparing their 5-player lineup's effectiveness to the "sum-of-the-parts." We find that these synergies can be large and meaningful. Because skills have different synergies with other skills, our framework predicts that a player's value is dependent on the other nine players on the court. Therefore, the desirability of a free agent depends on the players currently on the roster. Indeed, our framework is able to generate mutually beneficial trades between teams. Other ratings systems cannot generate mutually beneficial trades since one player is always rated above another. We find more than two hundred mutually beneficial trades between NBA teams, situations where the skills of the traded players fit better on their trading partner's team.Available here or on SSRN or on SSAC. Abstract available at IJCSS.

Citation: Maymin, Allan; Maymin, Philip Z.; Shen, Eugene (2013), "NBA Chemistry: Positive and Negative Synergies in Basketball," International Journal of Computer Science in Sport 12:2, 4-23.

Citation: Maymin, Allan; Maymin, Philip Z.; Shen, Eugene (2012), "NBA Chemistry: Positive and Negative Synergies in Basketball," Proceedings of the 6th Annual MIT Sloan Sports Analytics Conference.

Presentations

- 6th Annual MIT Sloan Sports Analytics Conference, March 2-3, 2012

Media and Press

- New York Times: Off the Dribble

- ESPN TV: Numbers Never Lie

- CBS Sports

- ESPN TrueHoop (2012)

- Basketball Prospectus (2012)

- ESPN TrueHoop (2011)

- Grantland: The Outstanding Mind-Bending Basketball Synergy Machine

Blogs and Discussions

- APBRmetrics (35 comments)

- Paul Kedrosky

SSRN Top Ten Download Lists

- Behavioral & Experimental Finance eJournal

- Decision Analysis eJournal

- Decision Making, Organizational Behavior & Performance eJournal

- Econometrics: Applied Econometric Modeling in Microeconomics eJournal

- ERN: Criteria for Decision-Making under Risk & Uncertainty (Topic)

- ERN: Team Theory (Topic)

- ERN: Teams (Topic)

- ERN: Sports Economics (Topic)

- FEN: Behavioral Finance (Topic)

- Labor eJournals

- Labor: Human Capital eJournal

- Labor: Personnel Economics eJournal

- Management Research Network

- Microeconomic Theory eJournals

- MRN Operations Research Network

- MRN Organizational Behavior Research Network

- Microeconomic Theory eJournals

- OPER Subject Matter eJournal

- OPER: Single Decision Maker (Topic)

- ORG Subject Matter eJournals

- ORG: Groups & Teams (Topic)

- Organizations & Markets: Personnel Management eJournal

- Organizations & Markets eJournals

Individual Factors of Successful Free Throw Shooting (with Allan Maymin and Eugene Shen)

We use three-dimensional optical tracking data on the 25-frames-per-second positional data of 2,400 free throw shots by the twenty players with at least twelve tracked makes and twelve tracked misses over the course of the 2010-2011 NBA season, fit each trajectory to a comprehensive physics model to find the implied backspin, initial launch height, velocity, angle, and left-right deviation, and examine the differences of those five factors between makes and misses for each player with sufficient attempts in our sample. We find that usually one or two factors are most responsible for a given player's misses, but the particular factors at fault differ across players. Thus, the causes of successes and failures in free throw shooting are idiosyncratic. This framework may also be useful in analyzing jump shots taken during the game.Available on SSRN and on JQAS.

Citation: Maymin, Allan; Maymin, Philip Z.; Shen, Eugene (2012), "Individual Factors of Successful Free Throw Shooting," Journal of Quantitative Analysis in Sports 8:3, doi:10.1515/1559-0410.1414.

Data

The data used in this paper has been made publicly available. Download CSV.

The 2,400 rows after the header row each represent the best-fit parameters of a single free throw trajectory following the methodology described in the paper.

The columns are: Player Name, Backspin (w), Launch Height (z), Launch Velocity (v0), Launch Angle (a), Left-Right Deviation (lr), and Made/Missed (result; 1=make, 0=miss).

Media and Press

- Fox News: Study reveals why NBA players miss free throws

- Sina Sports: 3D手段能让魔兽不再尴尬? 数据揭示罚球不中原因

SSRN Top Ten Download Lists

- Human Resource Management & Organizational Behavior eJournal

- Individual Issues & Organizational Behavior eJournal

- MRN Organizational Behavior Research Network

- ORG Subject Matter eJournals

- ORG: Biographical Issues, Ability, & Learning (Topic)

- ORG: Employee Performance Appraisal Systems (Topic)

A New Kind of Finance

Finance has benefited from the Wolfram's NKS approach but it can and will benefit even more in the future, and the gains from the influence may actually be concentrated among practitioners who unintentionally employ those principles as a group.Available on SSRN and arXiv and in the book.

Citation: Maymin, Philip Z. (2013), "A New Kind of Finance," in Irreducibility and Computational Equivalence: 10 Years After Wolfram's A New Kind of Science, Hector Zenil, ed., Springer Verlag.

Any Regulation of Risk Increases Risk (with Zak Maymin)

We show that any objective risk measurement algorithm mandated by central banks for regulated financial entities will result in more risk being taken on by those financial entities than would otherwise be the case. Furthermore, the risks taken on by the regulated financial entities are far more systemically concentrated than they would have been otherwise, making the entire financial system more fragile. This result leaves three directions for the future of financial regulation: continue regulating by enforcing risk measurement algorithms at the cost of occasional severe crises, regulate more severely and subjectively by fully nationalizing all financial entities, or abolish all central banking regulations including deposit insurance to let risk be determined by the entities themselves and, ultimately, by their depositors through voluntary market transactions rather than by the taxpayers through enforced government participation.Available on SSRN, arXiv, and on FMPM. Download PDF.

Citation: Maymin, Philip Z.; Maymin, Zakhar G. (2012), "Any Regulation of Risk Increases Risk," Financial Markets and Portfolio Management 26:3, 299-313.

Media and Press

- Library of Economics and Liberty: Why Financial Regulation is Doomed to Fail.

- American Banker (2010): Viewpoint: An Experiment in Securities Risk. Download PDF.

- LewRockwell.com: The War on Risk.

- Fairfield County Weekly: Listen Up, Chris Dodd.

Blogs and Discussions

- Portfolio Wizards

- Marginal Revolution (5 comments)

- Modeled Behavior (1 comment)

- Reddit Main Site (8 comments)

- Reddit Economics (2010) (26 comments)

Presentations

- Raising the Bar, April 29, 2014

- PRMIA Panel on Risk, Regulation, and Reality, February 19, 2014

- IAFE/Thalesians Seminar Series, October 8, 2012

- Society of Actuaries, October 18, 2011

- Oliver Wyman, November 19, 2010

- Stanford University Workshop on Capitalism's Crises, October 14, 2010

- NYU-Poly Alumni Day, May 16, 2010

SSRN Top Ten Download Lists

- CGN: Risk Management, Including Hedging and Derivatives (Topic)

- Risk Management eJournal

- ERN: Uncertainty and Risk Modeling (Topic)

- ERN: Regulation (IO) (Topic)

- Microeconomics: Decision-Making under Risk and Uncertainty eJournal

- IO: Regulation, Antitrust and Privatization eJournal

- Regulation of Financial Institutions eJournal

- Risk, Regulation, and Policy eJournal

- Banking & Financial Institutions eJournal

- Corporate Governance: Disclosure, Internal Control, and Risk-Management eJournal

How Much Trouble is Early Foul Trouble?

(with Allan Maymin and Eugene Shen)

We analyze a large and comprehensive play-by-play dataset of professional games in the National Basketball Association using tools from financial economics to explore the optimality of strategically idling resources in the face of uncertain future demand. We find that starters ought to be idled by the coach on a "Q+1" basis, meaning that a starter has one more foul than the current quarter, when the future option value is high or the value of the replacement player is high. We use a novel win-probability approach that can be easily extended to other applications.

Available on SSRN and IJSF. Data source: BasketballGeek. Download PDF.

Citation: Maymin, Allan; Maymin, Philip Z.; Shen, Eugene (2012), "How Much Trouble is Early Foul Trouble?", International Journal of Sport Finance 7:4, 324-339.

Citation: Maymin, Allan; Maymin, Philip Z.; Shen, Eugene (2011), "How Much Trouble is Early Foul Trouble?", Proceedings of the 5th Annual MIT Sloan Sports Analytics Conference.

Presentations

- 5th Annual MIT Sloan Sports Analytics Conference, March 5, 2011

- Southern Economic Association, November 19, 2011

Blogs and Discussions

- Mind Your Decisions

- Paul Kedrosky

- YCombinator Hacker News (15 comments)

- Baylor Fans (3 comments)

- Fighting Illini Basketball (12 comments)

- APBRmetrics

- Marginal Revolution (1 comment)

Media and Press

- The Wages of Wins Journal: "Adjusting Priors in Science, Basketball, and Life" by Allan Maymin, Philip Maymin, and Eugene Shen

- Slate: The Truth About Foul Trouble

- Basketball Prospectus: "Rethinking Foul Trouble" by Kevin Pelton

- ESPN TrueHoop: "How much trouble is early foul trouble?" by Brian Robb

- ESPN TrueHoop: "Research: Bench starters with fouls because they play poorly" by Henry Abbott

- The Atlantic: "NBA Coaches Should Yank Starters in Foul Trouble, Say Economists" by Derek Thompson

SSRN Top Ten Download Lists

- Behavioral & Experimental Finance (Editor's Choice) eJournal

- Behavioral & Experimental Finance eJournal

- FEN: Behavioral Finance (Topic)

- Economics Research Network

- Financial Economics Network

- ERN Subject Matter eJournals

- FEN Subject Matter eJournals

- ERN: Other Microeconomics: Decision-Making under Risk & Uncertainty (Topic)

- Microeconomic Theory eJournals

- Microeconomics: Decision-Making under Risk & Uncertainty eJournal

Constructing the Best Trading Strategy:

A New General Framework

(with Zak Maymin)

We introduce a new general framework for constructing the best trading strategy for a given historical indicator. We construct the unique trading strategy with the highest expected return. This optimal strategy may be implemented directly, or its expected return may be used as a benchmark to evaluate how far away from the optimal other proposed strategies for the given indicators are. Separately, we also construct the unique trading strategy with the highest information ratio. In the normal case, when the traded security return is near zero, and for reasonable correlations, the performance differences are economically insignificant. However, when the correlation approaches one, the trading strategy with the highest expected return approaches its maximum information ratio of 1.32 while the trading strategy with the highest information ratio goes to infinity.

Available on SSRN and JIS. Download PDF.

Citation: Maymin, Philip Z.; Maymin, Zakhar G. (2011), "Constructing the Best Trading Strategy: A New General Framework," Journal of Investment Strategies 1:1, 1-22.

SSRN Top Ten Download Lists

- ERN: Optimization Techniques; Programming Models; Dynamic Analysis (Topic)

- ERN: Speculation in Economic Markets (Topic)

- Econometrics: Mathematical Methods & Programming eJournal

Music and the Market: Song and Stock Volatility

Popular music may presage market conditions because people contemplating complex future economic behavior prefer simpler music, and vice versa. In comparing the annual average beat variance of the songs in the US Billboard Top 100 since its inception in 1958 through 2007 to the standard deviation of returns of the S&P 500 for the same or the subsequent year, a significant negative correlation is observed. Furthermore, the beat variance appears able to predict future market volatility, producing 2.5 volatility points of profit per year on average.Available on SSRN and on NAJEF.

Citation: Maymin, Philip Z. (2012), "Music and the Market: Song and Stock Volatility," North American Journal of Economics and Finance 23:1, 70-85.

Presentations

- 2013 Social Mood Conference, April 13, 2013

- 3rd Annual Meeting of the Academy of Behavioral Finance and Economics, September 22, 2011

- Tell Me Something I Don't Know, Episode 28, 36:53-42:29, September 24, 2017

Media and Press

- Forbes: How Our Choice In Music Moves The Stock Market (Or Not)

- Inverse: Did Taylor Swift Predict the Stock Market Collapse?

- Elliott Wave International: Dance and be Merry

- Article on SmartMoney.com: Can Music Predict the Stock Market's Volatility?

- Slideshow on SmartMoney.com: Music to Buy, Sell, or Hold By.

- Interview with The Takeaway on WNYC: Music to Invest By. Download MP3.

- Article in the Guardian (UK): Beyonce's new single spells economic doom.

- Interview on BBC Radio Ulster: Arts Extra (from 25:12 on).

- Article in the German-language Swiss daily Tages-Anzeiger.

- Interview with NYU-Poly website: Rickrolling Explained.

- Washington Square News: Prof. links music with poor economy.

- Interview on NPR's All Things Considered: Volatile Markets? Try Lada GaGa to Calm Down. Download MP3.

- Newsweek Poland: Muzyczne spadki.

- Financial Times Deutschland: Britney als schlechtes Omen. Print edition PDF.

- Boston Globe: Pop Goes the Market. Interactive graphic.

- Interview with Studio 360: Recession Pop. Download MP3. More recent blog post by interviewer Jocelyn Gonzales.

- Interview with NPR's Here and Now: Do Billboard Hits Reflect the Economy? Download MP3.

- Slideshow on CNBC: Eleven Surprising Stock Market Indicators.

- Interview with Laptop Rockers: Michael Jackson's Music Good for the Economy?

- Story on USA Today: Could the pop-culture mood mirror stock market swings?

Download cover (PDF, teaser at middle left).

Download front page of Money section (PDF, teaser at top).

Download main article (PDF, page B3). - Pop quiz on USA Today: Test your music knowledge.

- The Rachel Maddow Show on MSNBC.

- WABC

- CJAD

- Sirius/XM.

- Article in the Belgian business and economics newspaper De Tijd.

- New York Post: Flop Culture: How Music, Skirts, and the Weather Move Markets.

Can you perceive the relationship? Suggestive video on YouTube:

SSRN Top Ten Download Lists

- Banking & Financial Institutions Journals

- Capital Markets Journals

- Behavioral & Experimental Finance

- Cognition and the Arts eJournal

- CSN: Genre and Media (Topic)

- CSN: Music (Sub-Topic)

- CSN: Subject Matter eJournals

Markets are Efficient If and Only If P = NP

I prove that if markets are weak-form efficient, meaning current prices fully reflect all information available in past prices, then P = NP, meaning every computational problem whose solution can be verified in polynomial time can also be solved in polynomial time. I also prove the converse by showing how we can "program" the market to solve NP-complete problems. Since P probably does not equal NP, markets are probably not efficient. Specifically, markets become increasingly inefficient as the time series lengthens or becomes more frequent. An illustration by way of partitioning the excess returns to momentum strategies based on data availability confirms this prediction.Available on SSRN, on arXiv, and on AF.

Citation: Maymin, Philip Z. (2011), "Markets are Efficient If and Only If P=NP," Algorithmic Finance 1:1, 1-11.

Blogs and Discussions

- Andart

- Barry Ritholtz (8 comments)

- Discourse.net (8 comments)

- Maniagnosis

- Marginal Revolution (2011) (14 comments)

- Marginal Revolution (2010) (22 comments)

- Reddit Compsci (2013) (76 comments)

- Reddit Compsci (2011) (157 comments)

- Reddit Economics (2011) (41 comments)

- Reddit Math (2011) (16 comments)

- Reddit Economics (2010) (106 comments)

- Reddit Programming (2010) (23 comments)

- Reddit Math (2010) (11 comments)

- YCombinator Hacker News (2011) (83 comments)

- YCombinator Hacker News (2010) (58 comments)

Presentations

- Nomura and Oxford-Man Institute for Quantitative Finance Seminar, June 9, 2015

- NYU-Poly Alumni Day, May 22, 2011

- NYU Stern IOMS-IS Research Seminar, February 10, 2011

- Kent State University, September 24, 2010

- TEDxNSIT, "The Nature of Genius", March 30, 2010

SSRN Top Ten Download Lists

- Behavioral & Experimental Finance eJournal

- Capital Markets: Market Efficiency eJournal

- FEN: Behavioral Finance (Topic)

- ISN Subject Matter eJournals

- Capital Markets eJournal

- Information Systems and Economics eJournal

- Information Systems and eBusiness Network

- Information Systems: Behavioral & Social Methods eJournal

Self-Imposed Limits to Arbitrage

A multi-billion-dollar, multi-year discrepancy between two identical share classes of HSBC did not suffer from traditional external limits to arbitrage such as transactions costs and risk measures. One possible explanation is that self-imposed limits to arbitrage (SILTA) such as internal restrictions on position size allowed persistent mispricings. SILTA predicts a novel negative relation between relative volume and relative price. This prediction from SILTA holds not only for HSBC, but also other large mispriced pairs such as 3Com/Palm and Royal Dutch-Shell. Indeed, the implied overall maximum position size of arbitrageurs is roughly constant at one hundred days of trading volume for various mispriced pairs spanning different time periods and countries, suggesting SILTA as a possible explanation for all of them.Available on SSRN and JAF. Download PDF.

Citation: Maymin, Philip Z. (2011), "Self-Imposed Limits to Arbitrage," Journal of Applied Finance 21:2, 88-105.

Presentations

- 9th Annual Columbia-JAFEE Conference on Quantitative Finance, March 10, 2010

Behavioral Finance Has Come of Age (Editorial)

Did the recent financial crisis vindicate behavioral finance and vitiate rational finance? Perhaps the history of general relativity could guide the answer.Available on IOS Press.

Citation: Maymin, Philip Z. (2011), "Behavioral Finance Has Come of Age", Risk and Decision Analysis 2:3, 125.

Presentations

(General behavioral finance presentations)- Gerstein Fisher, July 12, 2011

- Columbia University Portfolio Management Seminar Program, May 26, 2011

- Columbia University Portfolio Management Seminar Program, May 23, 2012

- Columbia University Portfolio Management Seminar Program, June 7, 2013

Past Performance is Indicative of Future Beliefs

(with Gregg S. Fisher)

The performance of the average investor in an asset class lags the average performance of the asset class itself by an average of one percent per year over the past fifteen years, based on net investor mutual fund cash flows. We present a model in which a representative behavioral investor believes next year's returns will exactly match last year's returns and show that this leads to price adjustments on what would otherwise be random walk securities that effectively lower the future return of high performers and raise the future return of poor performers. The average predicted behavioral lag indeed matches the observed lag when asset returns are normally distributed with a mean and standard deviation equivalent to historical fifteen year averages of six percent and eighteen percent, respectively, and when the representative investor increases his allocation by 25 percent more than the return itself. In other words, investors chase returns and in doing so create the conditions of their own demise.

Available on SSRN and on IOS Press. Download PDF.

Citation: Maymin, Philip Z.; Fisher, Gregg S. (2011), "Past Performance is Indicative of Future Beliefs", Risk and Decision Analysis 2:3, 145-150.

Non-technical summary: When a fund performs well, investors pile in. Because they buy so much of it, it has a further increase in price. But this increase in price is not based on fundamentals, and will eventually reverse. That resulting drop in prices will cause losses for the investors who rushed in, especially when compared to other funds that did well. So those investors move on to the next performer, and again bump up its price and take the subsequent loss. In other words, investors chase performance, and by doing so, lose money, not because they are necessarily bad pickers, but because there are so many investors all making decisions the same way.

Blogs and Discussions

- CXO Advisory

- Bogleheads (24 comments)

- Falkenblog (1 comment)

- Abnormal Returns

Media and Press

- Globe and Mail

- Financial Times

- Forbes Online (2010)

- Forbes Online (2011)

SSRN Top Ten Download Lists

- ERN: Behavioral Finance (Topic)

- FEN: Behavioral Finance (Topic)

- Behavioral & Experimental Finance (Editor's Choice) eJournal

- Mutual Funds, Hedge Funds, and Investment Industry eJournal

- ERN: Econometric Modeling in Financial Economics (Topic)

- Household Finance eJournal

- Behavioral & Experimental Finance eJournal

- Microeconomics: General Equilibrium and Disequilibrium Models of Financial Markets eJournal

The Minimal Model of Financial Complexity

A representative investor generates realistic and complex security price paths by following this trading strategy: if, a few ticks ago, the market asset had two consecutive upticks or two consecutive downticks, then sell, and otherwise buy. This simple, unique, and robust model is the smallest possible deterministic model of financial complexity, and its generalization leads to complex variety. Compared to a random walk, the minimal model generates time series with fatter tails and more frequent crashes, thus more closely matching the real world. It does all this without any parameter fitting.Available on SSRN and on arXiv. Also see this introductory poster.

Citation: Maymin, Philip Z. (2011), "The Minimal Model of Financial Complexity," Quantitative Finance 11:9, 1371-1378.

Download PDF but please note:

Author Posting. (c) Taylor & Francis, 2010.

This is the author's version of the work. It is posted here by permission of Taylor & Francis for personal use, not for redistribution.

The definitive version was published in Quantitative Finance, 2010.

doi:10.1080/14697681003709447.

Presentations

- Cornell Financial Engineering Manhattan, September 28, 2011

Demonstrations

The minimal models can best be understood through live demonstrations. Step-by-step trader dynamics |

Prices Generated by Rule 54 |

Explore All Rules

|

See some videos of these demonstrations:

SSRN Top Ten Download Lists

- Financial Engineering

- ERN: Behavioral Finance (Topic)

- FEN Risk Journals

Preventing Emotional Investing: An Added Value of an Investment Advisor (with Gregg S. Fisher)

We analyze a unique, comprehensive, multi-decade dataset of all communications with clients by a boutique investment advisory and investment management firm to explore the behavior of individuals involved in financial decision making. We propose and test a theory of self-regulation to explain both the appeal and the value of investment managers to individual investors, and we find that all of the predictions of the theory are borne out by the data. In short, our unique dataset allows us to provide evidence that an important service provided by investment advisors, and apparently desired by individual investors, is the barrier the advisor provides to prevent the individual from aggressively trading and thereby losing money.Available on SSRN. Link to publisher.

Citation: Maymin, Philip Z.; Fisher, Gregg S. (2011), "Preventing Emotional Investing: An Added Value of an Investment Advisor," Journal of Wealth Management 13:4, 34-43.

Download PDF. The license for the PDF allows it to be printed once per person.

Presentations

- International Research Forum at the Hong Kong Polytechnic University and International Conference in Applied Statistics & Financial Mathematics, December 17, 2010

Blogs and Discussions

- AdvisorOne (1 comment)

- ActiveRain

- Truepoint Investor

Media and Press

SSRN Top Ten Download Lists

- CGN: Financial/Investment Practice (Topic)

- CGN: Gatekeepers (Topic)

- Household Finance eJournal

- Pension Risk Management eJournal

- Corporate Governance Practice Series eJournal

The Iron Fist vs. the Invisible Hand: Interventionism and libertarianism in environmental economic discourses

(with Tai Wei Lim)

Drawing from a broad range of sources, we define and discuss the two primary ways of contemplating issues related to environmental economics, namely, interventionism and libertarianism. We then interpret a cellular automaton as a model that allows for either approach, as well as anarchy, and show that interventionism exponentially reduces the number of possibilities while libertarianism, even when only probabilistically applied, tends to retain rather than destroy the underlying economic complexity. Thus, the libertarian, ex-post, remuneration approach may deserve more than the scant consideration it typically receives in such discourse, while the interventionist, ex-ante, regulation approach may have hidden long-term dangers not previously recognized. More generally, the approach outlined here may prove useful as a mechanism by which various regulatory proposals may be tested and compared.

Available on SSRN and WREMSD. Download PDF.

Citation: Maymin, Philip Z.; Lim, Tai Wei (2012), "The Iron Fist vs. the Invisible Hand: Interventionism and libertarianism in environmental economic discourses", World Review of Entrepreneurship, Management and Sustainable Development 8:3, 358-374.

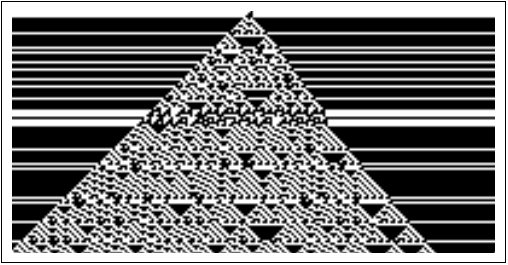

The following figure from the paper shows the result of a "noisy libertarian" evolution of pollution with an 80 percent enforcement probability on a rule 110 cellular automaton.

SSRN Top Ten Download Lists

- Environmental Economics eJournal

- Environmental Justice and Sustainability eJournal

- PSN: Environment (Topic)

- Political Economy: Development eJournal

- Political Economy: Structure and Scope of Government eJournal

- ERN: Structure, Scope, and Performance of Government (Topic)

- ERN: Other Political Economy: National, State and Local Government; Intergovernmental Relations (Topic)

Why Financial Regulation is Doomed to Fail (Editorial)

One might argue that the recent financial crisis demonstrates that financial regulations have backfired: Not only did the widespread regulations fail to prevent systemic risk, but, also, the systemic risk itself was even higher than it otherwise would have been in the absence of regulations. Is this argument true? If so, can the regulations be fixed? If not, what new regulations can be introduced to prevent a similar meltdown from happening in the future?Available on Library of Economics and Liberty. Download PDF.

Citation: Maymin, Philip Z. (2011), "Why Financial Regulation is Doomed to Fail", Library of Economics and Liberty, March 2011.

Metanoia and the Market

If investors randomly switch between being rational and irrational, then eventually the market will be half rational and half irrational, even if all investors start off rational, no matter how low the switching probability is. Thus, mispricings can persist even with continued volume between two fundamentally identical investments. Multiple survey results for hypothetical investment scenarios support this metanoia model. In short, the law of one price will be violated so long as there is any probability of switching: identical assets will have different prices.Available on SSRN. Download PDF. Link to publisher.

Citation: Maymin, Philip Z. (2011), "Metanoia and the Market", Journal of Behavioral Finance & Economics 1:1, Winter 2011, pp.27-42.

(NB: the JBFE was formerly known as ABFE: Advances in Behavioral Finance and Economics.)

Presentations

- 2nd Annual Meeting of the Academy of Behavioral Finance and Economics, September 16, 2010

Media and Press

- Whitebox Selected Research: Crazy is as Crazy Does

SSRN Top Ten Download Lists

- ESMST: Survey Methods (Topic)

Regulation Simulation

A deterministic trading strategy by a representative investor on a single market asset, which generates complex and realistic returns with its first four moments similar to the empirical values of European stock indices, is used to simulate the effects of financial regulation that either pricks bubbles, props up crashes, or both. The results suggest that regulation makes the market process appear more Gaussian and less complex, with the difference more pronounced for more frequent intervention, though particular periods can be worse than the non-regulated version, and that pricking bubbles and propping up crashes are not symmetrical.Available on SSRN and on arXiv. Download PDF. Link to publisher.

Citation: Maymin, Philip Z. (2009), "Regulation Simulation", European Journal of Finance and Banking Research 2:2, 1-12.

This paper uses the minimal model of financial complexity above to explore the effects of different regulatory environments. It also shows how the simulated price series resemble the actual price history in European equity markets.

SSRN Top Ten Download Lists

- ERN: Regulation (European) (Topic)

The Hazards of Propping Up: Bubbles and Chaos

In the current environment of financial distress, many governments are likely to soon become major holders of financial assets, but the policy debate focuses only on the likelihood and extent of short-term market stabilization. This paper shows that government intervention and propping up are likely to lead to long-term bubbles and even wildly chaotic behavior. The discontinuities occur when the committed capital reaches a critical amount that depends on just two parameters: the market impact of trading and the target exposure percentage.Available on SSRN and on arXiv. Download PDF. Link to publisher.

Citation: Maymin, Philip Z. (2009), "The Hazards of Propping Up: Bubbles and Chaos," The International Journal of Business and Finance Research 3:2, 83-93.

See the interactive demonstration.

See a video of the demonstration:

Media and Press

- AOL Daily Finance: Bull market or bubble? History suggests brace for the 'pop'. Excerpt:

Intuitively, it's almost too pretty a story: "This time it's different because of China."Phil Maymin, professor of finance and risk engineering at the Polytechnic Institute of New York University, doesn't buy that line for a second. "Wasn't it the early 80s when we were all enamored of Japan, the Rising Sun, the Eastern miracle? And the 90s was Taiwan and Thailand and Indonesia," Maymin says. "So now it's China. Bubbles, bubbles everywhere."

Yes, China's already a much bigger deal on a fundamental and economic basis than Japan or the Asian Tiger's ever could have hoped to be, but we wonder if investors aren't overpricing the would-be effects of the Middle Kingdom, if that is indeed the case.

We're going to have to go with Maymin -- not to mention Gluskin Sheff's David Rosenberg, star bank analyst Meredith Whitney and Nouriel "Dr. Doom" Roubini -- on this one. Like the fizzy lifting drink scene in Willy Wonka and the Chocolate Factory, we see bubbles, bubbles everywhere -- and fear they are propelling us right into the spinning blades of a fan.

SSRN Top Ten Download Lists

- IPE: International Finance and Investment (Topic)

- Political Methods Journals

- QM: Econometrics, Polimetrics, and Statistics (Topic)

- PSN: Econometrics, Polimetrics, and Statistics (Topic)

- Political Methods: Quantitative Methods eJournal

- MMFP: Comparative or Joint Analysis of Fiscal and Monetary Policy; Stabilization (Topic)

- ERN: Comparative or Joint Analysis of Fiscal and Monetary Policy; Stabilization (Topic)

Prospect Theory and Fat Tails

A behavioral representative investor who evaluates a single risky asset based on cumulative prospect theory will often induce high kurtosis, negative skewness, and persistent autocorrelation into the distribution of market returns even if the asset payoffs are merely a sequence of independent coin tosses. These findings continue to hold even when the investor is simply loss averse.Available on SSRN. Download PDF. Link to publisher.

Citation: Maymin, Philip Z. (2009), "Prospect Theory and Fat Tails," Risk and Decision Analysis 1:3, 187-195.

Presentations

- 5th Annual CARISMA Conference, February 2, 2010

- Gerstein Fisher, November 11, 2009

Media and Press

- Forbes Magazine: How to Protect Investments from Cataclysmic 'Fat Tails'

I wrote an article for Forbes (with Gregg S. Fisher) which refers to my research here.

Excerpt:

"And get the bits together, the fat tail, every good part." Ezekiel 24:4If you traveled back in time thousands of years to tell Abraham, Moses or Ezekiel that you had some fat tails, they would have been delighted. In ancient times, the fat tails of certain Middle Eastern sheep were considered a delicacy. Today, they're more often associated with investment cataclysms.

...

Recent research suggests that in certain cases, investors subject to these two biases--loss aversion and mental accounting--will generate fat tails via their trading activity. In trying to avoid losses and compartmentalize investment decisions, they can exacerbate moves upward and down. For example, when earnings randomly rise, investors buy more; and when earnings fall, they sell. This is not very logical, but it is very human.

The Conventional Past, Behavioral Present, and Algorithmic Future of Risk and Finance

Modern finance is a relatively young field, only a few decades old, and already it has gone through two phase transitions and is perhaps poised to undergo a third. The first transition starting from the 1950s brought modern portfolio theory into the mainstream with econometric and optimization based approaches to portfolio construction and risk management. The second transition starting from the 1990s shifted those conventional approaches based on rational investors into a focus on the actual psychological factors driving investor behavior along with the important concept of limits to arbitrage. The third transition happening now aims to take an algorithmic approach to finance, looking to explore how and why investor heuristics evolve and predominate, how automated processes can respond to unpredictable events, and what the effects will be on the markets as ever-faster computers trained on ever-larger data sets become the predominant and nearly real-time traders.Available on open access.

Citation: Maymin, Philip Z. (2018), "The Conventional Past, Behavioral Present, and Algorithmic Future of Risk and Finance," Finance - Challenges of the Future 20, 74-84.

Presentations

- SUNY Farmingdale Conference on Financial Mathematics, April 18, 2015

Using Scouting Reports Text To Predict NCAA → NBA Performance

Draft decisions by National Basketball Association (NBA) teams are notoriously poor. Analytics can help but are often dismissed for being too overfit, complex, risky, and incomplete. To address these concerns, we train separate leave-one-out random forests machine learning models for each collegiate NBA prospect from 2006 through 2019 with a conservative utility function on a novel comprehensive dataset including the raw text of scouting reports, combine measurements, on-court stats, mock draft placements, and more. Despite being unable to draft high school or international players, the resulting model outperforms the actual decisions of all but one NBA team, with an average gain of $100 million. Target shuffling shows that the model does not overfit and feature shuffling shows that handedness and ESPN mock draft rating, but not other mock drafts, are most important. NBA teams may be missing value by not following a disciplined, model-driven, prescriptive analytics approach to decision making.Available on JBA.

Citation: Maymin, Philip Z. (2021), "Using Scouting Reports Text To Predict NCAA → NBA Performance" Journal of Business Analytics DOI: 10.1080/2573234X.2021.1873077

Smart kills and worthless deaths: eSports analytics for League of Legends

Vast data on eSports should be easily accessible but often is not. League of Legends (LoL) only has rudimentary statistics such as levels, items, gold, and deaths. We present a new way to capture more useful data. We track every champion’s location multiple times every second. We track every ability cast and attack made, all damages caused and avoided, vision, health, mana, and cooldowns. We track continuously, invisibly, remotely, and live. Using a combination of computer vision, dynamic client hooks, machine learning, visualization, logistic regression, large-scale cloud computing, and fast and frugal trees, we generate this new high-frequency data on millions of ranked LoL games, calibrate an in-game win probability model, develop enhanced definitions for standard metrics, introduce dozens more advanced metrics, automate player improvement analysis, and apply a new player-evaluation framework on the basic and advanced stats. How much does an individual contribute to a team’s performance? We find that individual actions conditioned on changes to estimated win probability correlate almost perfectly to team performance: regular kills and deaths do not nearly explain as much as smart kills and worthless deaths. Our approach offers applications for other eSports and traditional sports. All the code is open-sourced.Available on JQAS.

Citation: Maymin, Philip Z. (2021), "Smart kills and worthless deaths: eSports analytics for League of Legends," Journal of Quantitative Analysis in Sports, 17:1, pp. 11-27. https://doi.org/10.1515/jqas-2019-0096

Presentations

- MIT Sloan Sports Analytics Conference, February 23-24, 2018

Research Paper Alpha Award Grand Prize - NESSIS, September 23, 2017

Wage Against the Machine: A Generalized Deep-Learning Market Test of Dataset Value

How can you tell if a particular sports dataset really adds value? The method introduced in this paper provides a way for any analyst in almost any sport to attempt to determine the additional value of almost any dataset. It relies on the use of deep learning, comprehensive historical box score statistics, and the existence of betting markets. When the method is applied as an illustration to a novel dataset for the NBA, it is shown to provide more information than regular box score statistics alone, and appears to generate above-breakeven wagering profits.

Citation: Maymin, Philip Z. (2019), "Wage Against the Machine: A Generalized Deep-Learning Market Test of Dataset Value," International Journal of Forecasting, Special Issue on Sports Forecasting, 35:2, 776-782.

Presentations

- Sports Analytics Innovation Summit, September 10, 2015

Media and Press

- When Deep Learning Met Vantage Data, December 27, 2015

Blogs and Discussions

- APBRmetrics (5 comments)

The Automated General Manager: Can an Algorithmic System for Drafts, Trades, and Free Agency Outperform Human Front Offices?

An automated system using machine learning methods, applied to a broad historical database, while avoiding survivorship bias, and for a variety of performance metrics, is developed and tested against actual historical human performance, for drafts, free agency, and trades, in the National Basketball Association (NBA). The resulting system is robust, comprehensive, realistic, and does not overfit information from the future. Backtested over ten years in a partial equilibrium non-zero-sum setting where only one team can benefit from its recommendations, the automated general manager would have outperformed the actual historical production of every single team, by substantial margins. From draft decisions alone, the average team lost about $130 million worth of on-court productivity relative to what they could have had with the automated general manager in total over the decade; this shortfall represents a quarter of the average franchise value. Thus, the general management of sports franchises may benefit substantially from automation.Citation: Maymin, Philip Z. (2017), "The Automated General Manager: Can an Algorithmic System for Drafts, Trades, and Free Agency Outperform Human Front Offices?" Journal of Global Sport Management, 2:4, 234-249.

Presentations

- Cornell Financial Engineering Manhattan Seminar, April 11, 2018 video

Blogs and Discussions

- Marginal Revolution (31 comments)

- Wages of Wins (8 comments)

- Sports Analytics Blog

Media and Press

- Medium: The Cost Of Bad Drafting

- Wall St. Cheat Sheet: The 6 Best Drafting Teams in the NBA, And the High Cost of Poor Picks

- NYU Press Room: FRE Professors Take Two of Top Five SSRN Spots

SSRN Top Ten Download Lists

- Weekly Top 5 - May 16, 2014

- ERN Subject Matter eJournals

- Economics Research Network

- Labor eJournals

- Labor: Personnel Economics eJournal

- All SSRN Journals

Acceleration in the NBA: Towards an Algorithmic Taxonomy of Basketball Plays

I filter the 25-frames-per-second STATS/SportVu optical tracking data of 233 regular and post season 2011-2012 NBA games for half-court situations that begin when the last player crosses half-court and end when possession changes, resulting in a universe of more than 30,000 basketball plays, or about 130 per game. To categorize the plays algorithmically, I describe the requirements a suitable dynamic language must have to be both more concise and more precise than standard X's and O's chalk diagrams. The language specifies for each player their initial starting spots, trajectories, and timing, with iteration as needed. A key component is acceleration. To determine optimal starting spots, I compute burst locations on the court where players tend to accelerate or decelerate more than usual. Cluster analysis on those burst points compared to all points reveals a difference in which areas of the court see more intense action. The primary burst clusters appear to be the paint, the top of the key, and the extended elbow and wing area. I document the most frequently accelerating players, positions, and teams, as well as the likelihoods of acceleration and co-acceleration during a set play and other components intended to collectively lead to an algorithmic taxonomy.Available on SSRN.

Citation: Maymin, Philip Z. (2013), "Acceleration in the NBA: Towards an Algorithmic Taxonomy of Basketball Plays," Working Paper.

Citation: Maymin, Philip Z. (2013), "Acceleration in the NBA: Towards an Algorithmic Taxonomy of Basketball Plays," Proceedings of the 7th Annual MIT Sloan Sports Analytics Conference.

Presentations

- The Innovation Enterprise Sports Analytics Summit, September 10-11, 2014

- 7th Annual MIT Sloan Sports Analytics Conference, March 1-2, 2013

- Grantland

Media and Press

- SAP: "X-Y Marks The Spot: SportVu Cameras Are Changing The World of Stats"

- Yahoo! Sports: "Maymin's work could lead to a fresh new method of quantifying in-play execution, which is just about always the division between good NBA teams and bad ones."

- Sports Illustrated: "Maymin draws all kinds of conclusions from the data collected, but most relevant were his findings regarding Pierce. In the data from the 2011-12 season (the extent of Maymin's set), Pierce rated as one of the league's most frequent accelerators, comparing favorably to the likes of Kevin Durant and Dwyane Wade."

- Sports Illustrated: The Fundamentals

- Deadspin

- ESPN

Blogs and Discussions

SSRN Top Ten Download Lists

- ERN: Statistical Decision Theory; Operations Research (Topic)

Behavioral Despair in the Talmud

(with Zakhar G. Maymin and Zina N. Maymin)

We solve two "unsolvable" (teyku) problems from the Talmud that had remained unsolved for about one and a half thousand years despite massive and nearly continuous commentary and analysis throughout the centuries. The Talmudic problems concern the implied decision-making of farmers who have left some scattered fruit behind, and the alleged impossibility of knowing whether they would return for given amounts of fruit over given amounts of land area if we aware of their behavior at exactly one point. We solve the problems by formalizing the Talmudic discussion and expressing five natural economic and mathematical assumptions that are also eminently reasonable in the original domain. If we also allow a sixth assumption regarding the farmer's minimum wage, we can solve two other related unsolvable problems.

Citation: Maymin, Philip Z.; Maymin, Zakhar G.; Maymin, Zina N. (2017), "Behavioral Despair in the Talmud: New Solutions to Unsolved Millennium-Old Legal Problems," Asian Journal of Law and Economics 8:2.

Blogs and Discussions

SSRN Top Ten Download Lists

- AARN: Case Studies of Religious Groups (Topic)

- AARN: Judaism (Sub-Topic)

- Ancient Philosophical & Scientific Texts eJournal

- Anthropology of Religion eJournal

- CRN Subject Matter eJournals

- CRN: Ancient Epistemology (Topic)

- CRN: Ancient Ethics (Topic)

- CRN: Ancient Logic (Topic)

- CRN: Ancient Mathematics & Physics (Topic)

- Classics Research Network

- Decision Making

- Management Research Network

- MRN Organizational Behavior Research Network

- Organizational Behavior & Performance eJournal

- OPER: Single Decision Maker (Topic)

- ORG: Rationality, Cognition, & Decision Making (Topic)

- ORG Subject Matter eJournals

- Philosophy of Religion eJournal

Lambda-Q Calculus (1996-1997)

Extending the Lambda Calculus to Express Quantumized Algorithms

I introduce a formal metalanguage called the lambda-q calculus for the specification of quantum programming languages. This metalanguage is an extension of the lambda calculus, which provides a formal setting for the specification of classical programming languages.As an intermediary step, I introduce a formal metalanguage called the lambda-p calculus for the specification of programming languages that allow true random number generation. I demonstrate how selected randomized algorithms can be programmed directly in the lambda-p calculus.

I also demonstrate how satisfiability can be solved in the lambda-q calculus.

View the complete manuscript. Available on arXiv.

The Lambda-Q Calculus Can Efficiently Simulate Quantum Computers

I show that the lambda-q calculus can efficiently simulate quantum Turing machines by showing how the lambda-q calculus can efficiently simulate a class of quantum cellular automaton that are equivalent to quantum Turing machines.I conclude by noting that the lambda-q calculus may be strictly stronger than quantum computers because NP-complete problems such as satisfiability are efficiently solvable in the lambda-q calculus but there is a widespread doubt that they are efficiently solvable by quantum computers.

View the complete manuscript. Available on arXiv.

Programming Complex Systems

Classical programming languages cannot model essential elements of complex systems such as true random number generation. I develop a formal programming language called the lambda-q calculus that addresses the fundamental properties of complex systems. This formal language allows the expression of quantumized algorithms, which are extensions of randomized algorithms in that probabilities can be negative, and events can cancel out.View the complete manuscript. Available on arXiv.

Citation: Maymin, Philip Z. (2003), "Programming Complex Systems," in Yaneer Bar-Yam (Ed.), Unifying Themes in Complex Systems, Vol. I, Proceedings of the First International Conference on Complex Systems (1997), Chapter 32, pp. 325-341, Colorado: Westview Press.